Join our WhatsApp Community

AI-powered WhatsApp community for insights, support, and real-time collaboration.

Caribbean banks are scaling GenAI from pilots to production. The 2025 CAB-Fluid AI report reveals how the region is leading responsible, on-premise AI transformation.

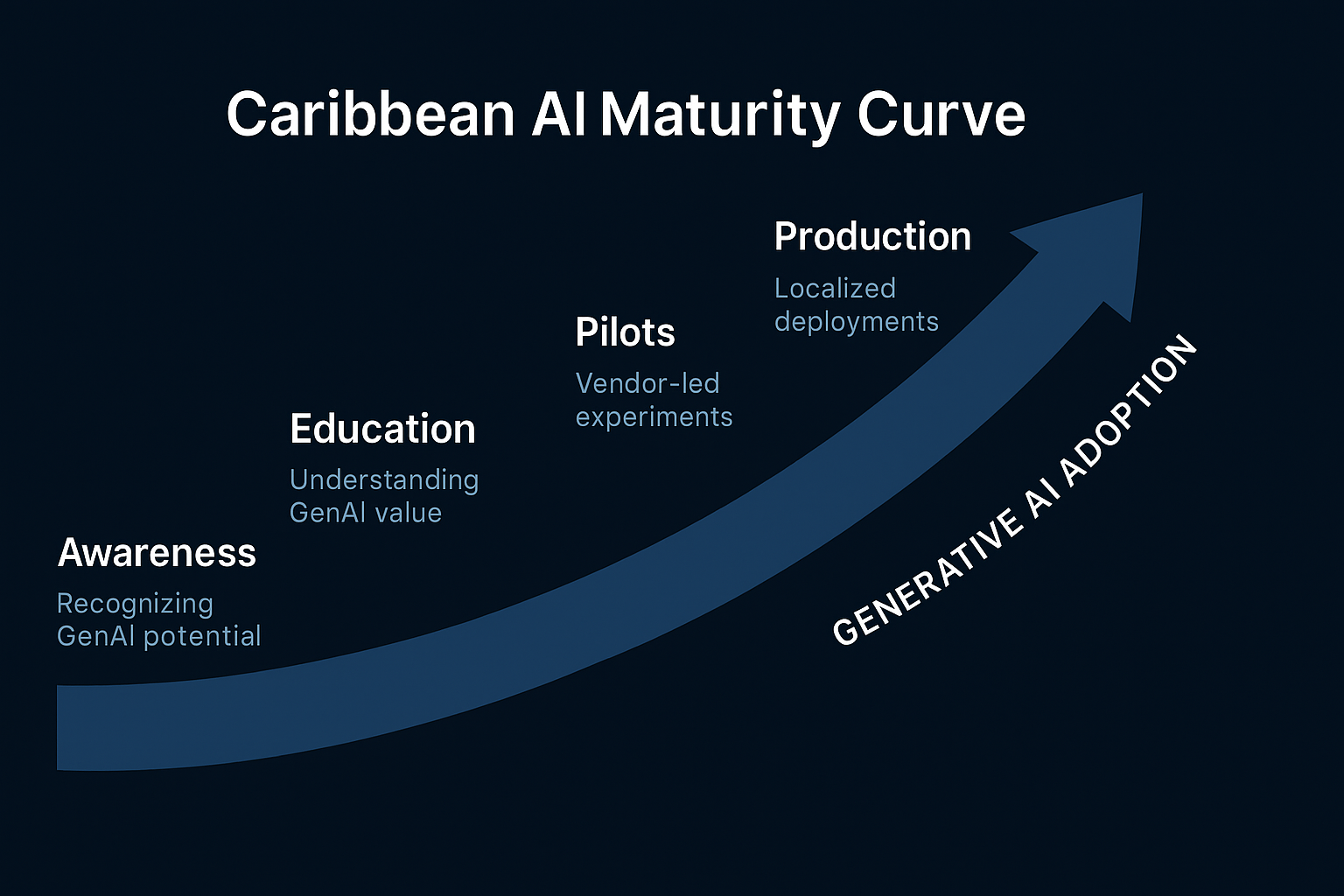

Caribbean banks are no longer experimenting with AI — they’re operationalizing it. Across the region, financial institutions are scaling from pilots to production, blending compliance, efficiency, and regional data sovereignty into real transformation.

Developed in collaboration with the Caribbean Association of Banks (CAB), this initiative marks a turning point: GenAI and Agentic AI are now being embedded into hybrid on-premise frameworks that balance innovation with regulation.

Fluid AI’s on-premise Agentic Platform sits at the core of this shift — helping regional banks move beyond chatbots and copilots into autonomous, auditable intelligence.

👉 Download the full Caribbean GenAI Report for the complete dataset, frameworks, and case studies.

| Why is AI important in the banking sector? | The shift from traditional in-person banking to online and mobile platforms has increased customer demand for instant, personalized service. |

| AI Virtual Assistants in Focus: | Banks are investing in AI-driven virtual assistants to create hyper-personalised, real-time solutions that improve customer experiences. |

| What is the top challenge of using AI in banking? | Inefficiencies like higher Average Handling Time (AHT), lack of real-time data, and limited personalization hinder existing customer service strategies. |

| Limits of Traditional Automation: | Automated systems need more nuanced queries, making them less effective for high-value customers with complex needs. |

| What are the benefits of AI chatbots in Banking? | AI virtual assistants enhance efficiency, reduce operational costs, and empower CSRs by handling repetitive tasks and offering personalized interactions. |

| Future Outlook of AI-enabled Virtual Assistants: | AI will transform the role of CSRs into more strategic, relationship-focused positions while continuing to elevate the customer experience in banking. |

Across Kingston, Port of Spain, and Bridgetown, boardrooms are no longer asking “Can AI help us?” — they’re asking “How soon can we scale it safely?”

The Harnessing GenAI in Caribbean Banking – Fall 2025 report, developed in collaboration with the Caribbean Association of Banks (CAB), reveals that over 50% of regional banks now identify AI as a strategic driver of digital transformation.

The transition from experimentation to execution is well underway — powered by new cloud infrastructure, hybrid AI architectures, and a wave of public–private innovation funding.

This isn’t just about chatbot pilots anymore — it’s about building end-to-end, governed AI systems that can reason, act, and comply.

Fluid AI’s on-premise Agentic Platform plays a pivotal role in this shift, enabling banks to embed GenAI and Agentic AI directly into their core operations while maintaining compliance and data sovereignty.

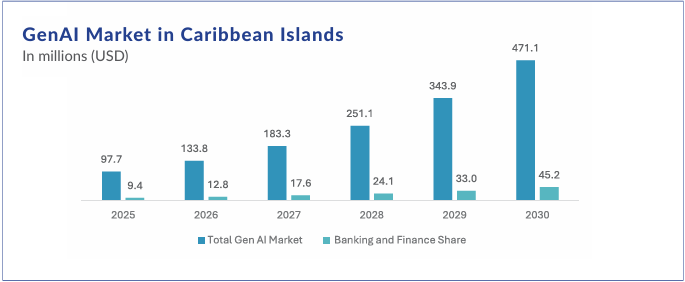

While global markets have seen $1.38 billion in GenAI investments in 2024, the Caribbean’s AI market — though smaller at $97.7 million — is growing nearly 37% annually, one of the fastest worldwide.

This isn’t a copy-paste of global models. Caribbean regulators, banks, and infrastructure providers are co-developing frameworks that blend innovation with sovereignty — ensuring data never leaves national or regional boundaries.

The Blue NAP Americas GPU Cloud in Curaçao and the Caribbean Federated Cloud initiative have been key in allowing AI model hosting that meets local compliance standards.

The region’s story isn’t about potential — it’s about results.

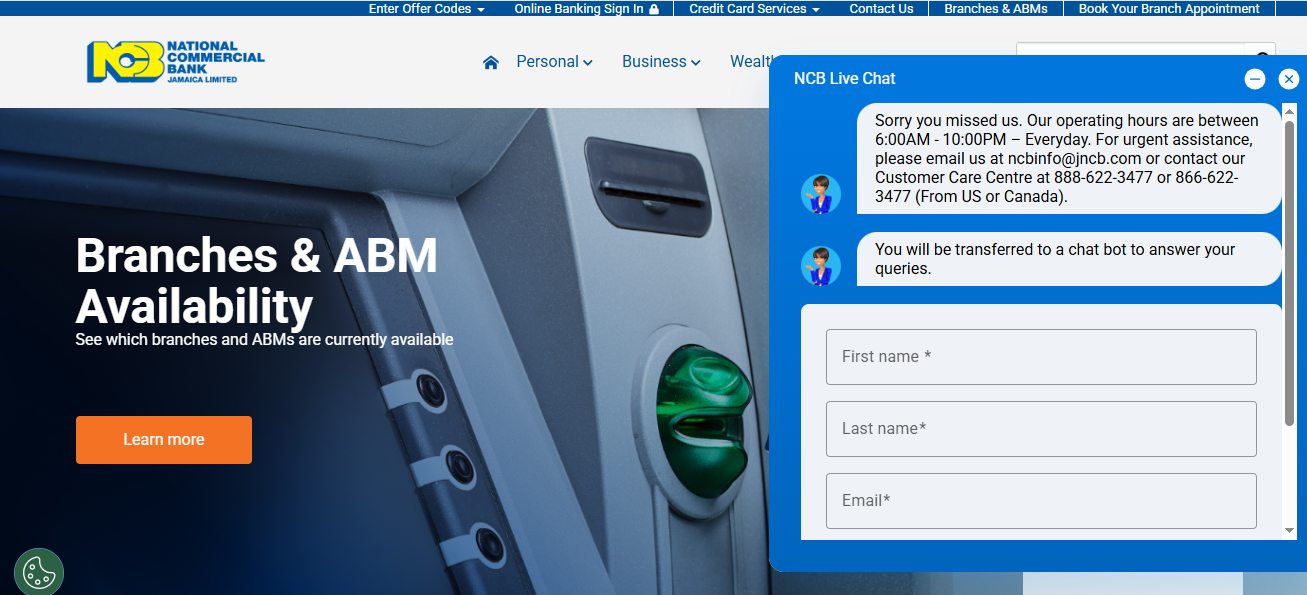

NCB Jamaica – Simone & AssistBiz:

Launched in partnership with Fluid AI, NCB’s Simone handles 200,000+ support requests yearly, while AssistBiz enables business clients to manage service tickets digitally. Together, they helped the bank close branches, boost profits by 92%, and support Jamaica’s JAM-DEX rollout.

First Citizens TT – Ani:

Trinidad’s Ani AI assistant reduced live-agent handovers by 40%, cutting wait times and enhancing digital adoption.

BONI – Tookitaki AML Suite:

The Bank of Nevis International applied AI to compliance — reducing false positives and improving fraud detection speed.

These examples prove a simple point: AI isn’t replacing banking teams — it’s scaling them.

2025 was about copilots; 2026 will be about agents — autonomous digital operators that reason, decide, and act across multiple systems.

Agentic AI brings intelligence to life inside enterprise workflows — not just suggesting, but executing.

It connects CRM data, risk engines, and compliance frameworks through an orchestration layer that maintains auditability and human oversight.

To see how this architecture works in practice, explore Fluid AI’s product overview detailing its orchestration and governance layers.

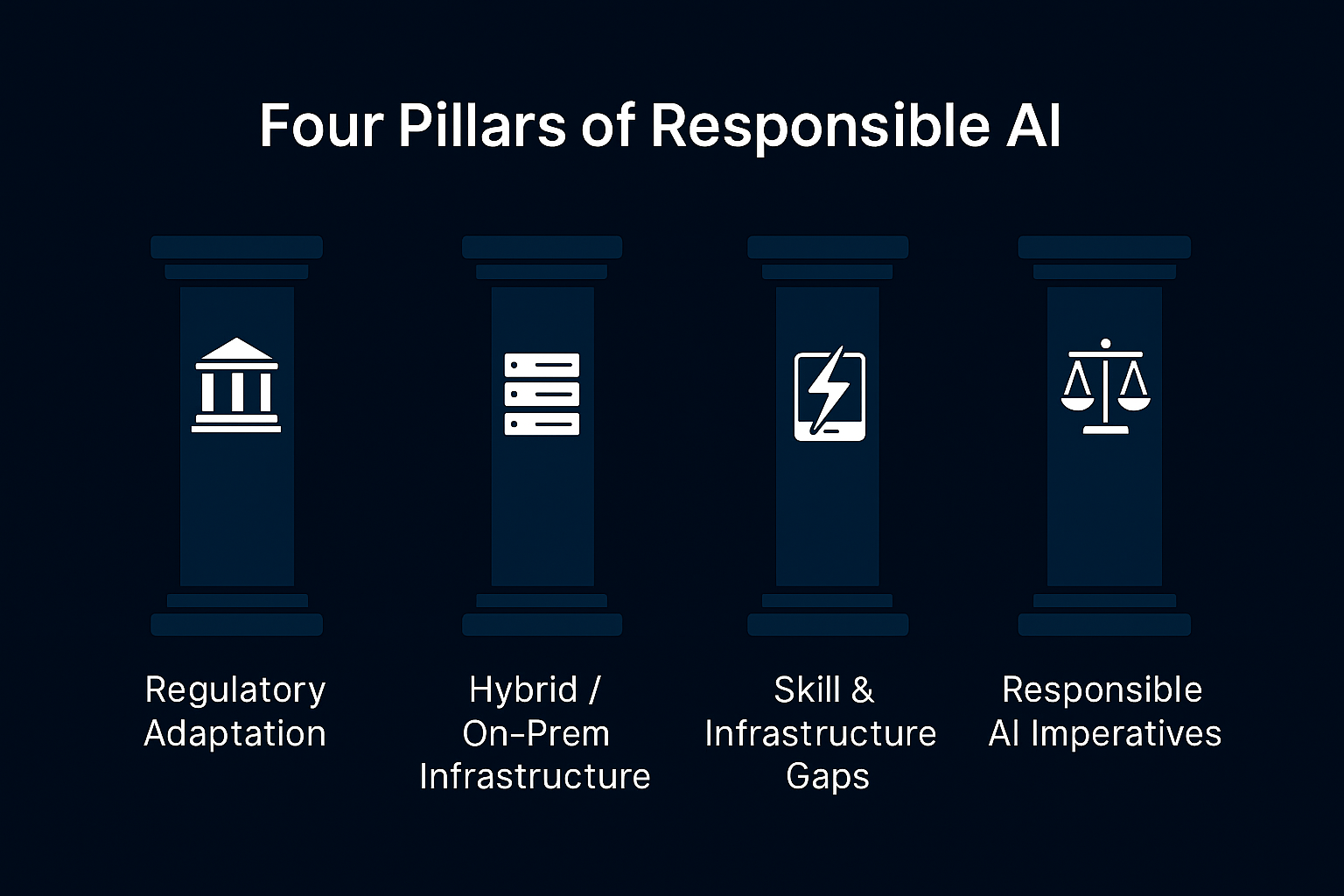

Even as adoption rises, the report notes four key blockers slowing full-scale deployment:

But these aren’t roadblocks — they’re design parameters.

Fluid AI’s on-premise deployment model and governance-first architecture directly address these realities — ensuring control without compromising agility.

The Strategic Framework Localization section of the report identifies four pillars shaping AI readiness across the region:

AI deployments must adhere to GDPR-inspired data laws — from Jamaica’s 2020 Data Protection Act to Barbados’s 2019 framework. This requires compliance-by-design.

Given strict data residency rules, banks prefer hybrid models where models and data remain regionally hosted. Fluid AI’s modular Agentic AI supports this exact setup.

Caribbean banks are establishing AI Centers of Excellence (CoEs) and partnering with universities to build the next wave of GenAI engineers.

Bias testing, explainability dashboards, and human-in-the-loop supervision are now non-negotiable for trust in AI systems.

The report outlines a Pilot–Validate–Scale roadmap that’s becoming the regional benchmark.

This mirrors Fluid AI’s sandbox-to-scale framework, which balances innovation with enterprise-grade control.

Caribbean banks are setting a global example in AI accountability. The report recommends implementing a Unified Control Framework (UCF) — a governance architecture that standardizes 42 controls across ethics, bias, transparency, and auditability.

This includes:

In short: governance isn’t slowing innovation — it’s enabling sustainable scale.

To explore this concept deeper, read our analysis on enterprise orchestration and compliance-ready AI.

For Caribbean CXOs planning their 2026 strategy, the report offers a clear playbook:

These practices ensure that when banks scale, they scale safely.

For a closer look at how this approach applies in real deployments, explore Fluid AI’s customer support automation solutions.

The final section of the report captures the real vision: a transition from human-assisted automation to AI-assisted autonomy.

“By pursuing these strategies, Caribbean banks can evolve from pilot deployments to enterprise-wide AI transformation — positioning the region as an emerging hub for intelligent, responsible banking.”

Fluid AI’s Agentic Platform enables exactly this — integrating GenAI and Agentic AI into banking systems securely, on-premise, and with full auditability.

Regional institutions are now using agents to analyze credit risk, manage compliance, and automate service operations with traceable decision loops and human-in-the-loop guardrails.

Banks across the Caribbean aren’t just catching up — they’re leapfrogging into a new era where AI becomes the interface of the enterprise.

The Caribbean’s GenAI story isn’t about scale — it’s about shape.

By embedding ethics, compliance, and sovereignty into their AI architectures, regional banks are defining what responsible intelligence looks like for emerging markets.

The institutions that act now — not by experimenting, but by executing — will set the benchmark for ethical, intelligent finance globally.

👉 Download the complete report here to explore detailed charts, regional forecasts, and case studies from the Fall 2025 Caribbean Banking AI report.

Fluid AI is an AI company based in Mumbai. We help organizations kickstart their AI journey. If you’re seeking a solution for your organization to enhance customer support, boost employee productivity and make the most of your organization’s data, look no further.

Take the first step on this exciting journey by booking a Free Discovery Call with us today and let us help you make your organization future-ready and unlock the full potential of AI for your organization.

AI-powered WhatsApp community for insights, support, and real-time collaboration.

.webp)

.webp)

Join leading businesses using the

Agentic AI Platform to drive efficiency, innovation, and growth.

AI-powered WhatsApp community for insights, support, and real-time collaboration.